If you find yourself unavailable to go through this requirement, check this out and see how we may be able to help. But to give you a quick answer, BIR registration fee is basically based on the number of you certificate of registration COR. You only need to pay one registration fee for one business registration. What happened was she paid twice for the same BIR Form This is just a reminder because there are still some business owners and professionals who think that the P BIR registration fee is only paid once and they might forget to pay it annually.

| Uploader: | Zolomuro |

| Date Added: | 19 December 2012 |

| File Size: | 57.99 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 80024 |

| Price: | Free* [*Free Regsitration Required] |

And if you can send me the bir rulings for rf late payment. Previous tab Fodm tab. If you have the older version, go to this link and download the latest one. Need po bang kmuha ulit ng cert of registration na may bagong tatak for ? What will I do?

Hence, it would be best if you consult or get the service of a BIR accredited tax agent to process your business closure. FullSuite Team December 11, I suggest you pay it earlier to avoid additional interests.

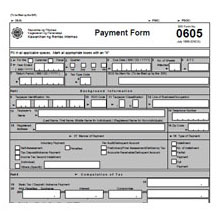

Philippine Government Forms - BIR Form

All registered taxpayers, except those earning purely compensation income, are required to pay the annual registration fee with BIR. I will be registering as an Insurance Agent. Usually, the bank will check your certificate of registration or TIN card which you should bring to verify your tax identification number.

If you have registered by mistake, you may visit the RDO and try to update your registration information using BIR Application for Registration Update — but first, confirm this with the RDO officer if that is the best thing to do. When is the deadline for paying our BIR annual registration fee?

But as long as the filing and payment are made on or before the due date and it was properly validated, then I think it should be okay.

Beginner's Guide to Registration Fee (BIR Form ) - FullSuite

What about the books of accounts? Do I have to do anything like go to BIR to have it validated? Should I pay PhP only? To get started, you may visit this article from our Help Fprmfor you to learn the step by step process in filing this return. In terms of books of accounts, you can either register a new book or continue to use your old book if all the pages are not yet consumed. Business Tips, really bi this article!

For Item 2, Year Ended should be December for calendar year. Sobrang haba po kz ng pila, ubos na po kz sa traffic at sa pila ang buong maghapon.

0605 Payment Form

Restaurant po kase yung samin, we just renewed our Business last january but we still forj have the print out snce wala pa kameng fire safety certificate. Go to your BIR office and ask for requirements. Need ko lang po ba magbayad ng s authorized bank ng pesos?

This is my first time to renew my self-employed BIR registration. Thank you in advance. Forn it mean that you do not need to have an updated Certificate of Registration.

Your help would be much appreciated. I failed to pay my annual registration for the yearand What should I bring with me to the RDO? The Form was filed on January 15, …. How much did you pay for registration and penalty?

After po magbayad no need na po pumunta sa RDO? I am about to pay for the renewal of registration. But there is also another equally important registration renewal that needs to be done before January 31st.

Комментариев нет:

Отправить комментарий